Section 179 Tax Savings on Commercial Vehicles in Delaware

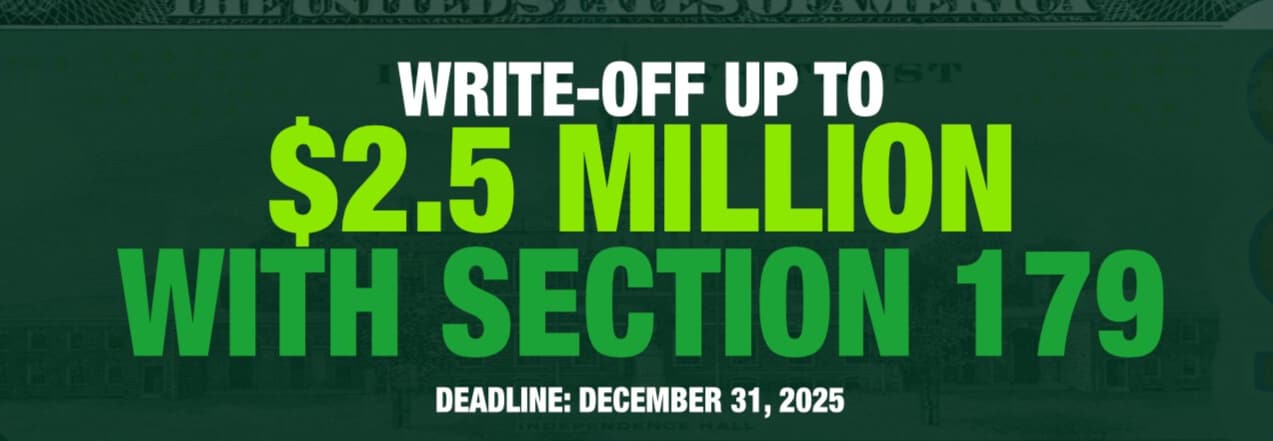

With Section 179 Tax Deductions, businesses can deduct the full cost of qualifying vehicle purchases in the year they are placed in service, improving their cash flow and reducing their tax liability for 2025. These write-offs are a great boon for local businesses around the Northeast Region that heavily rely on commercial vans and trucks. Learn more about it with Bayshore Ford Truck Center in New Castle, serving Wilmington, New York, Philadelphia, and Dover.

Key Points at a Glance

- The full Section 179 deduction is available for new and used vocational trucks and vans

- Heavy SUVs & trucks with over 6,000 pounds GVW have a $31,300 maximum deduction through Section 179

- To be eligible, a vehicle must exceed 50% business use

- The purchase/finance deadline is that a commercial vehicle must be in service by December 31st, 2025

Limitations Explained

- Section 179 deductions phase out dollar-for-dollar when total equipment purchases begin to exceed $4,000,000

- Full phase out at $6,500,000

- Heavier passenger vehicles (6,000 to 14,000 pound GVWR) have a special $31,300 Section 179 cap.